2022 was an eventful year at CSi! With 2023 right around the corner, we’ve compiled a roundup of some of the most notable experiences that shaped our organization this year.

The most significant development this year took place in June with the announcement of our firm’s new partnership with HUB International. HUB International is a leading full-service global insurance broker providing products and services for risk management, insurance, employee benefits, retirement, and wealth management. Based on 2021 revenue*, HUB is ranked as the fifth largest insurance brokerage globally. Its vast network brings clarity to a changing world, offering tailored solutions and unrelenting advocacy so clients are prepared for tomorrow. When CSi was founded in 1971, it was with the mission of providing retirement, investment, and financial advisory services to our clients in a proficient and personalized way. Our partnership with HUB provides the opportunity to expand on this original vision, by leveraging the vast offerings and expertise of an international brokerage, while still retaining our focus on localized client services and specializations.

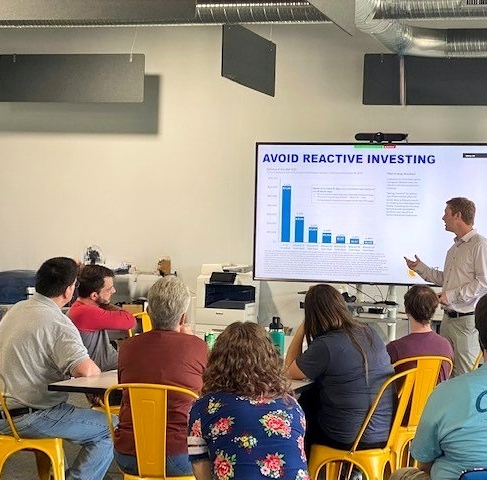

Outside of our new partnership, much of our work this year was business as usual. Our firm had one of its fastest growing years in terms of new retirement plan clients, with a 70% increase in new plans onboarded compared to 2021. CSi is as committed as ever to expanding access to high quality retirement plans and independent financial advice. For many workers, factors like busy schedules or location can limit their ability to connect with a financial professional. Through methods such as in-person site visits and group education meetings, we meet people where they are in an effort to remove as many barriers as possible. With each year, the number of total participant interactions continue to increase - a tangible example of how our firm makes a meaningful impact on an individual level.

Along with these education methods, we continued our CSi Financial Wellness Webinar Series, and hosted six virtual events this year. The quarterly webinars covered the topics of Taking Control of Your Finances, ROTH: What You Need to Know, Insurance for Different Stages of Life, and Investing Basics. Additional information and webinar recordings can be found at the Past Events page on our website.

In response to the market volatility and inflation that occurred this year, we presented two additional webinars to address the questions and concerns of our clients. In January, we kicked off with the 2022 Market Outlook webinar, featuring insight and forecasts from LPL Research market strategist Ryan Detrick. Then, to address the economic disruptions, war, and inflation that transpired throughout the first half of the year, we hosted Midyear Outlook 2022: Navigating Turbulence in August.

Further solidifying CSi’s position as a thought-leader in the retirement industry, team members participated in a variety of conferences and speaking engagements throughout the year. One highlight was the SHRM HR Indiana Conference, one of the largest HR conferences in the country. Kristi Baker was chosen as a session speaker, and presented Measure What Matters: Using Metrics to Improve Employee Retirement Outcomes.

Another conference highlight was participating in the Indiana Association of School Business Officials (IASBO) Annual Meeting, which brings together hundreds of public school business officials from across the state of Indiana. In the Exhibit Hall, Kelli Davis and Kyle Brown met attendees and discussed the retirement plan and financial wellness services that are available to school districts and their staff at the CSi booth.

Did you know Kelli has focused in the school plan market for 15 years, and currently works with over 25 school districts on their retirement plan? For more on how Kelli assists educators and school officials, read our Q&A blog post HERE.

Our office welcomed three new team members and two interns in 2022. In February, Kyle Brown joined CSi as a Relationship Consultant. In August, Pat McNamara started as a Relationship Manager. These two hires are responsible for providing support to manage a book of institutional retirement plan clients and guiding our business development and new client acquisition efforts. Luke Dunham joined CSi in August as a Financial Client Service Professional, and serves as primary support to lead advisors, and oversees client interactions and front desk management. Finally, our CSi Internship Program continued with the arrival of Luke Kozlowski & Joey Gruszkowski in June. The two Butler University students spent the summer with us gaining real-life work experience and exploring their career interests in the financial services industry. Get to know more about all our 2022 hires by visiting their profiles on our website HERE.

Of course, it’s not all work and no play here at CSi! In 2022, we were able to keep our older traditions alive while also introducing some new ones. Some highlights include a March Madness Kickoff Party, the annual CSi Fun Day (this year at Top Golf), sponsoring and playing in the Same As U Golf Tournament, and our annual Christmas Party.

CSi was recognized with several industry awards in 2022. A significant highlight is the recognition of CSi’s Kristi Baker and Kelli Davis on the PLANADVISER 2022 Top Retirement Plan Advisers list.

Check out the Awards & Recognitions page on our website for more.

Comentários